Buying a Home in Turkey with a Mortgage

Turkey, known for its rich cultural heritage, strategic location, and diverse landscapes, has become an attractive destination for property buyers. Whether for investment, vacation, or permanent residence, buying a home in Turkey has piqued the interest of both local and international buyers. One of the primary means of financing such a purchase is through a mortgage. This analysis delves into the process, benefits, challenges, and future prospects of buying a home in Turkey with a mortgage.

Buying a home in Turkey with a mortgage presents a compelling opportunity for both local and international buyers. The vibrant real estate market, coupled with various mortgage options and government incentives, makes it an attractive proposition. However, potential buyers must navigate economic fluctuations, legal requirements, and currency risks. By staying informed and engaging local experts, buyers can make well-informed decisions and capitalize on the growth potential of Turkey’s real estate market. As the market evolves, continued economic recovery, technological advancements, and sustainable development are set to shape the future landscape of property investment in Turkey.

The Turkish Real Estate Market

Current Trends and Opportunities

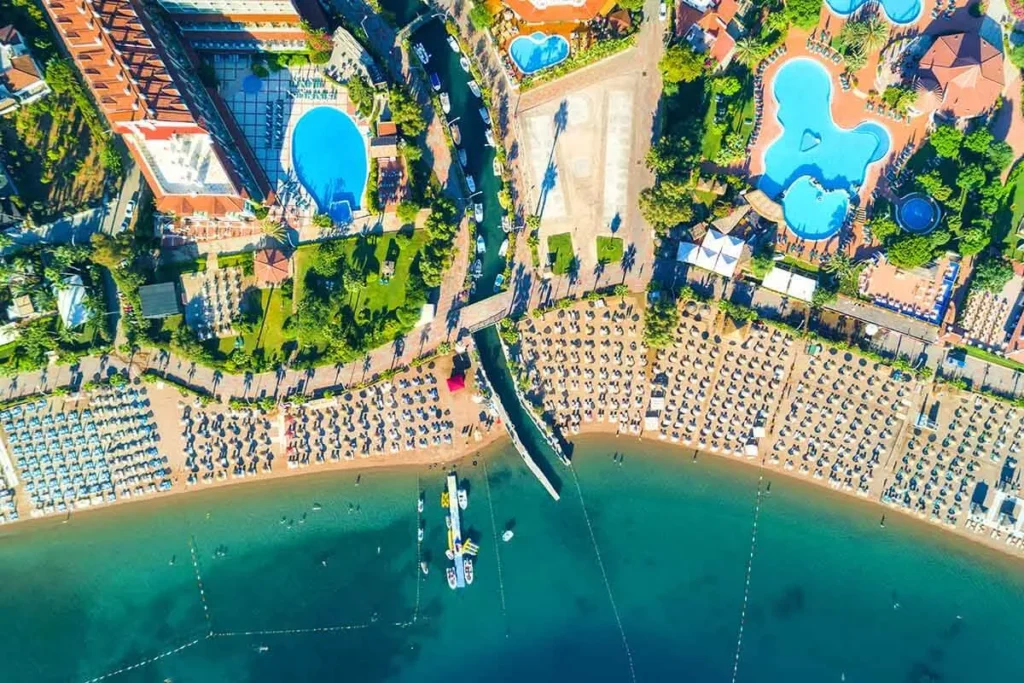

The Turkish real estate market has seen substantial growth over the past decade, driven by factors such as urbanization, economic development, and government incentives. Key cities like Istanbul, Ankara, and Izmir offer a blend of modern amenities and historical charm, making them prime locations for real estate investment. Coastal areas such as Antalya and Bodrum attract buyers looking for vacation homes.

Market Dynamics

- Urbanization: Rapid urbanization has increased demand for residential properties in major cities.

- Foreign Investment: Legislative changes have made it easier for foreigners to buy property in Turkey, boosting the market.

- Economic Factors: Economic fluctuations and currency exchange rates impact property prices and mortgage terms.

Mortgage Options in Turkey

Types of Mortgages

Turkey offers several types of mortgages, catering to the diverse needs of buyers:

- Fixed-Rate Mortgages: Interest rates remain constant throughout the loan term, providing stability in monthly payments.

- Variable-Rate Mortgages: Interest rates fluctuate based on market conditions, potentially offering lower initial rates.

- Foreign Currency Mortgages: These are available for non-residents and are denominated in foreign currencies like USD or EUR, protecting against exchange rate volatility.

Eligibility and Requirements

Obtaining a mortgage in Turkey involves several steps and documentation:

- Creditworthiness: Banks assess the applicant’s credit history and financial stability.

- Property Valuation: An official appraisal of the property is required to determine its market value.

- Legal Documentation: Necessary documents include a valid passport, proof of income, and a Turkish tax identification number.

Process of Buying a Home with a Mortgage

Initial Steps

- Research and Property Selection: Buyers should thoroughly research neighborhoods, property types, and market prices.

- Pre-Approval: Securing a mortgage pre-approval helps in understanding the budget and speeds up the buying process.

Application and Approval

- Mortgage Application: Submit the required documents to the chosen bank.

- Assessment and Approval: The bank evaluates the application, including a property appraisal and credit assessment.

- Mortgage Offer: If approved, the bank issues a mortgage offer outlining the terms and conditions.

Finalizing the Purchase

- Purchase Agreement: Sign a purchase agreement with the seller, often involving a down payment.

- Title Deed Transfer: The final step is the transfer of the title deed (Tapu) at the Land Registry Office, upon which the mortgage funds are released.

Benefits of Buying a Home with a Mortgage in Turkey

Financial Leverage

Mortgages enable buyers to leverage their financial resources, allowing them to invest in higher-value properties than they could afford with cash.

Tax Benefits

Turkey offers various tax incentives for property buyers, including reduced property tax rates and exemptions for first-time buyers.

Investment Potential

Real estate in Turkey has shown considerable appreciation over time, making it a sound investment. Mortgaging a property allows buyers to benefit from this appreciation while spreading the cost over several years.

Diversification

For international buyers, purchasing property in Turkey offers an opportunity to diversify their investment portfolio geographically.

Challenges and Considerations

Economic and Political Stability

Turkey’s economy has faced volatility in recent years, and political stability can impact the real estate market. Buyers should be aware of these factors when making long-term investment decisions.

Currency Exchange Risks

For foreign buyers, fluctuations in exchange rates can affect the affordability and overall cost of the mortgage. Opting for foreign currency mortgages can mitigate this risk but may come with higher interest rates.

Legal and Bureaucratic Hurdles

Navigating the legal and bureaucratic landscape in Turkey can be challenging, especially for foreigners. It’s advisable to engage local legal and real estate experts to ensure compliance with all regulations.

Mortgage Terms and Conditions

Interest rates and mortgage terms in Turkey can differ significantly from those in other countries. Prospective buyers should thoroughly understand the terms and negotiate favorable conditions.

Future Prospects

Economic Recovery and Growth

As Turkey continues to recover from economic downturns and the global pandemic, the real estate market is expected to stabilize and grow. Government initiatives aimed at boosting the construction sector and foreign investment will likely contribute to this growth.

Technological Advancements

The adoption of digital technologies in real estate transactions, such as online property listings, virtual tours, and digital mortgage applications, is expected to streamline the buying process and attract tech-savvy buyers.

Sustainable Development

There is an increasing focus on sustainable and eco-friendly developments in Turkey. Properties with green certifications and energy-efficient features are becoming more popular, aligning with global trends and attracting environmentally conscious buyers.

International Demand

The appeal of Turkey as a destination for international buyers is likely to grow, driven by its unique cultural heritage, favorable climate, and strategic location between Europe and Asia. Simplified processes for foreigners to obtain residency and citizenship through property investment will further bolster this demand.